Islamic Economic System and Islamic Microfinance

Islamic microfinance faces several challenges in its operation within the Islamic economic system. One significant challenge is the lack of awareness and understanding about Islamic finance principles among potential clients. Many individuals are unf...

Read more →Key Takeaways

- Overview of Halal Mortgages in Islamic Finance

- Understanding the Principles of Sharia Mortgages

- Exploring Interest-Free Home Ownership through Islamic Mortgages

- Guide to Choosing and Managing Islamic Mortgages

- Summary of Halal Mortgages in the Real Estate Market

A Deep Dive into Halal Mortgages

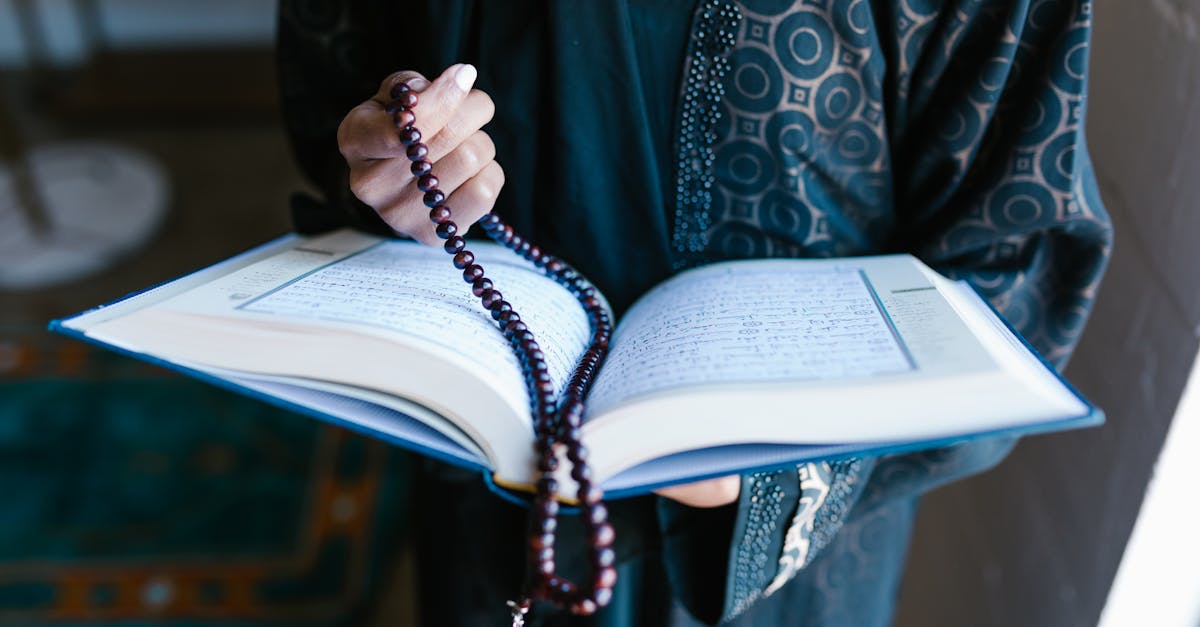

To truly understand the essence of halal mortgages, delving into the intricacies of this specialised form of home finance is fundamental. Islamic finance principles govern the structure of halal mortgages, ensuring they comply with Sharia law. The distinguishing factor between halal mortgages and conventional ones lies in the prohibition of interest in Islamic finance, emphasising equitable transactions that promote shared risk and reward. This distinctive feature fosters a system of home ownership that aligns with the principles of fairness and ethical conduct in Islamic finance.

The Concept Behind Halal Mortgages

Halal mortgages are financial products designed to facilitate home purchases for Muslims in a Sharia-compliant manner. These mortgages operate in adherence to Islamic principles, ensuring that the transaction is free from interest (riba) and complies with Sharia law. Unlike conventional mortgages, halal mortgages do not involve interest payments, which aligns with the beliefs of Muslims who seek to avoid riba in their financial dealings when acquiring a home loan.

For Muslims looking to purchase a home, halal mortgages offer a viable solution that is in accordance with Sharia principles. These mortgages provide an avenue for individuals to secure funding for a home purchase without engaging in interest-based transactions. By opting for halal mortgages, individuals can fulfil their dream of homeownership while staying true to their religious beliefs and values.

| Halal Mortgage Provider | Key Features |

|---|---|

| Ijara | Lease-to-own arrangement where the bank purchases the property and leases it to the buyer with an option to buy at the end of the term. |

| Murabaha | Cost-plus financing where the bank buys the property and sells it to the buyer at a higher price, allowing for deferred payments. |

| Musharaka | Partnership or joint venture arrangement where the bank and buyer contribute funds to purchase the property, sharing ownership and profits. |

How Halal Mortgages Differ From Conventional Ones

Halal mortgages stand out from their conventional counterparts due to their adherence to Islamic financial principles. Unlike traditional mortgages that involve paying interest (riba), halal mortgages are structured in a shariah-compliant manner. One prevalent form of halal mortgage is the murabaha, where the lender purchases the property and sells it to the buyer at a markup – making it a mortgage alternative that aligns with the rules of Islam.

In the realm of finance, the distinction between halal mortgages and conventional ones comes down to the principles they are built upon. Islamic financial institutions offer halal mortgages that uphold the teachings of Islam by avoiding interest-based transactions. For individuals seeking a shariah-compliant way to purchase a home in Australia, exploring the details of halal mortgages is essential. If you want to delve deeper into this mortgage option, feel free to contact us for guidance on how halal mortgages differ from traditional ones.

The Guiding Principles of Islamic Finance

The principles of Islamic finance play a pivotal role in the realm of halal mortgages. When it comes to navigating the landscape of property finance, understanding the essence of Islamic finance is paramount. Islamic home financing, also known as halal home loans, operates on the basis of shariah compliant practices. In the context of a home purchase plan, individuals seeking a halal mortgage must ensure that all financial dealings adhere to the principles of halal finance. Whether engaging with a lender or structuring a property finance agreement, the foundation of Islamic finance sets the tone for a sharia-compliant approach to halal mortgages.

The Role of Islamic Finance in Buying a Home

Islamic finance plays a crucial role in enabling individuals to purchase their first home through the use of halal mortgages. These finance products adhere to Islamic principles such as ijarah, musharaka, and ijara, ensuring that the transaction remains Sharia-compliant. When seeking to buy a property with halal mortgages, individuals can benefit from the transparent and ethical nature of these arrangements, which are structured to align with Islamic teachings while also helping to preserve property value over time.

For those looking to buy a home in accordance with Islamic principles, opting for a Sharia mortgage can provide a viable interest-free alternative. By understanding the mechanisms of Sharia mortgages and weighing the pros and cons, individuals can make informed decisions to secure financing for their property purchases. These Sharia-compliant options offer a pathway to home ownership that is consistent with Islamic finance principles, allowing individuals to navigate the landscape of Islamic mortgages with confidence and clarity.

Essential Tenets of Islamic Finance Related to Mortgages

Islamic finance related to mortgages operates on the core principles of Sharia law, catering to the needs of Muslim individuals seeking halal mortgages. Islamic banks provide finance for Muslims by offering various types of mortgages that comply with the principles of Islamic finance. When applying for Islamic home finance in Australia, individuals turn to mortgage providers that offer halal mortgages, ensuring the transactions adhere to the principles of fairness, transparency, and ethical conduct set forth by Islamic finance.

Islamic finance principles within the context of mortgages emphasize the prohibition of riba (interest) and gharar (uncertainty), making halal mortgages distinct from conventional mortgage systems. To secure an Islamic mortgage, applicants must adhere to the specific rules and guidelines outlined by Islamic finance to ensure compliance with Sharia law. By understanding the essential tenets of Islamic finance related to mortgages, individuals can navigate the process of obtaining halal mortgages in a manner that aligns with their religious beliefs and values.

- Compliance with Sharia law is a fundamental requirement for Islamic mortgages.

- Prohibition of riba (interest) and gharar (uncertainty) distinguishes halal mortgages from conventional ones.

- Islamic banks offer various types of mortgages that align with Islamic finance principles.

- Applicants seeking Islamic home finance in Australia look for providers offering halal mortgages.

- Essential tenets such as fairness, transparency, and ethical conduct guide Islamic mortgage transactions.

- Understanding Islamic finance principles is crucial for obtaining halal mortgages in accordance with religious beliefs.

Sharia Mortgage An InterestFree Path to Home Ownership

Decoding the mechanism of Sharia Mortgages unveils an innovative approach to home ownership grounded in Islamic principles. The emergence of Sharia Mortgages has provided an interest-free alternative for those seeking to purchase property while adhering to their religious beliefs. In Australia, financial institutions such as the Canadian Halal Financial Corporation offer Sharia-compliant financial services tailored towards facilitating the acquisition of homes through halal mortgages. This unique model ensures that the buyer ultimately owns the property, aligning with the fundamental Islamic finance principle of asset-backed transactions.

Decoding the Mechanism of Sharia Mortgages

When delving into the workings of Sharia mortgages, it is crucial to understand the fundamental principle behind these financial solutions. Unlike conventional mortgages with interest-based transactions, Sharia mortgages align with Islamic religious principles and offer halal alternatives for home ownership. In the realm of Islamic finance, individuals seeking to finance home purchases can opt for a range of Islamic mortgage alternatives that adhere to Sharia law. Instead of charging interest over the finance term, these mortgages involve shared ownership arrangements, where the financial institution and the buyer jointly own the property. To grasp the essence of Sharia mortgages, consulting with a mortgage and real estate expert can provide valuable insights into navigating this unique facet of halal mortgages.

Pros and Cons of Choosing Sharia Mortgages

One advantage of choosing sharia mortgages is that they provide a sharia-compliant and ethical Islamic finance option for individuals looking to purchase a home without engaging in interest-based transactions. Unlike conventional mortgages, sharia home loans adhere to the principles of Islamic finance, ensuring that the end of the term, the buyer becomes the rightful owner of the property without the burden of interest payments.

On the other hand, one potential drawback of opting for sharia mortgages is that they may have higher upfront costs compared to other Islamic mortgage alternatives available in the market. While sharia-compliant financing offers a no-interest home purchase solution, borrowers may find that the initial fees and charges associated with these halal mortgages can be more significant, requiring careful evaluation of the overall affordability and long-term benefits of this Islamic finance option.

- Sharia mortgages align with Islamic finance principles and do not involve interest-based transactions.

- The buyer becomes the rightful owner of the property at the end of the term without interest payments.

- Higher upfront costs may be a drawback of sharia mortgages compared to other Islamic mortgage options.

- Initial fees and charges associated with sharia mortgages can be significant.

- Borrowers need to carefully assess affordability and long-term benefits when opting for sharia mortgages.

Navigating the Landscape of Islamic Mortgages

Australian Muslims looking to navigate the landscape of Islamic mortgages in Australia have a variety of options available to them. From understanding the principles of halal mortgages to exploring the mechanisms of sharia-compliant financing, individuals can turn to Islamic financial institutions for guidance. These institutions provide a unique approach to home buying that aligns with Islamic finance principles. When considering purchasing a home, it is essential to research halal mortgage providers and compare their offerings to ensure that the terms align with sharia law. By delving into the specifics of halal mortgages in Canada, prospective homebuyers can make informed decisions about their mortgage options in accordance with their beliefs.

Steps to Secure an Islamic Mortgage in Australia

When looking to secure halal mortgages in Australia, it is crucial to connect with financial institutions specializing in Sharia-compliant finance solutions. These institutions understand the importance of adhering to halal ways of financing, ensuring that the home loans Australia they offer align with Islamic principles. One common practice in Islamic finance is 'Ijarah,' where the bank buys the property and sells it back to the customer at a profit, allowing individuals to embark on their home journey through halal mortgages.

To navigate the landscape of halal mortgages in Australia, individuals must conduct thorough research to find financial institutions that offer interest-free home loans. Seeking guidance from experts in Islamic finance can aid in understanding the intricacies of Sharia-compliant mortgages, ensuring that individuals make informed decisions when choosing their finance options for purchasing a property.

| Financial Institution | Halal Mortgage Type | Key Features |

|---|---|---|

| Islamic Finance Australia | Ijarah Home Financing | Property purchased by the bank and sold back at a profit |

| Halal Home Loans | Murabaha Home Financing | Property bought by the bank and sold to the customer at a markup price |

| Arab Bank Australia | Musharakah Home Financing | Property co-owned by the bank and customer, with profits and risks shared |

| Qudos Bank | Istisna'a Home Financing | Property constructed by the bank based on customer's specifications |

Common Misconceptions Regarding Islamic Mortgages

One common misconception about Islamic mortgages is that they are not easily accessible for those seeking home financing. However, with the increasing demand for halal mortgages, many financial institutions are now offering dedicated mortgage services that cater to the needs of the Muslim community. These mortgage products are designed to be shariah-compliant, offering an alternative to conventional mortgages that involve paying interest.

Another misconception is that finding a halal mortgage can be a complex and time-consuming process compared to applying for a regular mortgage. In reality, many banks and lenders in Australia now provide halal mortgages, simplifying the process for individuals who prefer a mortgage product that aligns with their religious beliefs. By choosing halal mortgages, individuals can fulfill their homeownership dreams in a way that is in line with shariah principles.

wrapping it all up

In conclusion, the concept of Halal Mortgages offers a viable solution for individuals seeking home ownership in accordance with Islamic principles. Unlike conventional mortgages where interest is involved, Halal Mortgages operate on an ethical basis through the bank purchasing the property and then selling it back to the customer at a mutually agreed price. This process ensures that both Muslim and non-Muslim individuals can navigate the property market without compromising their beliefs. As the demand for ethical financial solutions continues to rise, institutions like MCCA Asset Management are at the forefront of providing Halal Mortgages, catering to the present and emerging needs of the community.

FAQS

What is a halal mortgage?

A halal mortgage, also known as a Sharia-compliant or Islamic mortgage, is a financial product that adheres to Islamic laws and principles, particularly those related to riba (interest) and gharar (uncertainty).

How does a halal mortgage differ from a conventional mortgage?

Halal mortgages differ from conventional mortgages as they do not involve the payment or receipt of interest, which is considered haram (forbidden) in Islamic finance. Instead, halal mortgages use alternative structures such as Murabaha (cost-plus financing) or Ijara (leasing) to facilitate home ownership.

What are the guiding principles of Islamic finance that apply to halal mortgages?

The guiding principles of Islamic finance that apply to halal mortgages include the prohibition of interest, the avoidance of uncertainty and speculation, the promotion of risk-sharing, and the adherence to ethical and moral standards in financial transactions.

How can one secure an Islamic mortgage in Australia?

To secure an Islamic mortgage in Australia, individuals can approach Islamic banks or financial institutions that offer Sharia-compliant products. It is recommended to consult with Islamic finance experts to understand the terms and structures of halal mortgages available in the Australian market.

What are the pros and cons of choosing a Sharia mortgage?

The pros of choosing a Sharia mortgage include the compliance with Islamic principles, the promotion of ethical finance, and the avoidance of interest-based transactions. However, some cons may include limited product options, potentially higher costs, and the need for a thorough understanding of Islamic finance concepts.

Islamic Economic System and Shariah Compliance

Islamic Economic Development in the context of Shariah compliance is a fundamental aspect of the Islamic economic system. It encompasses principles and practices that aim to promote sustainable growth, ethical conduct, and social welfare within a fra...

Read more →

Islamic Economic System and Takaful Industry

Regulations and compliance play a crucial role in ensuring the stability and integrity of the Takaful sector. Islamic insurance operates under a set of ethical and Sharia-compliant principles, requiring strict adherence to guidelines to maintain tran...

Read more →

Islamic Economic System and Islamic Investment Funds

Risk management is a crucial aspect of Islamic investments, ensuring financial stability and compliance with Sharia principles. Islamic investment funds need to adopt effective strategies to mitigate risks and protect investors' interests. One key ap...

Read more →

Islamic Economic System and Sukuk Market

Regulations and standards play a crucial role in shaping the landscape of Islamic finance, ensuring adherence to ethical and Sharia-compliant practices. The principles underpinning Islamic finance are based on the prohibition of interest (riba), unce...

Read more →

Islamic Economic System and Islamic Banking

Regulating Islamic banking institutions is a critical aspect of ensuring their compliance with Sharia principles. This regulation involves the oversight of financial activities to uphold ethical and religious guidelines. Supervisory authorities play ...

Read more →

Islamic Economic System and Islamic Finance

Islamic financial institutions play a crucial role in the Islamic economic system by providing interest-free financial services to individuals and businesses in accordance with Islamic principles. These institutions operate based on Sharia laws, whic...

Read more →

Islamic Economic System and Halal Industry

Islamic banking principles are deeply rooted in Sharia law, which prohibits the payment or acceptance of interest on loans. This fundamental concept ensures that financial transactions are conducted in a manner that is ethical and socially responsibl...

Read more →

Islamic Economic System and Environmental Conservation

Climate change is a pressing global issue that is of significant concern from an Islamic perspective. In the Quran, there are teachings that highlight the importance of preserving the Earth and its resources. For instance, Muslims are called upon to ...

Read more →

Islamic Economic System and Sustainable Development

Social welfare is a fundamental aspect of the Islamic economic framework, emphasizing the importance of caring for the less fortunate in society. In Islam, the concept of Zakat is central to social welfare, which requires Muslims to donate a portion ...

Read more →

Islamic Economic System and Social Justice

Wealth distribution in Islamic societies follows a unique approach that upholds the principles of justice, equality, and compassion. Islam emphasizes the fair distribution of wealth among members of society to ensure that no individual is left in pov...

Read more →

Islamic Economic System and Poverty Alleviation

Islamic Investment Strategies play a crucial role in the framework of Islamic finance, encompassing ethical principles and guidelines derived from Sharia law. One fundamental aspect of Islamic investment is the prohibition of riba, or interest, which...

Read more →

Islamic Economic System and Wealth Distribution

Wealth management in Islam is guided by a set of ethical and moral principles that ensure the fair and just distribution of resources within society. Islamic teachings emphasize the importance of using wealth in a responsible manner, with a focus on ...

Read more →

Waqf in the Islamic Economic System

Contemporary applications of Waqf funds showcase the versatility and adaptability of this Islamic economic concept in addressing modern societal needs. By channeling Waqf contributions towards education and healthcare initiatives, communities are abl...

Read more →

Zakat and Islamic Economic System

Zakat, a fundamental pillar of Islamic finance, is increasingly gaining attention in modern economic practices. This ancient concept of wealth redistribution finds its relevance today in the pursuit of a more equitable and just financial system. The ...

Read more →

Fintech Solutions for Islamic Asset Management

Several key players are making waves in the realm of Fintech innovations for Islamic asset management. One notable company is Wahed Invest, which offers halal investment options through an online platform, providing easy access to sharia-compliant in...

Read more →

Role of Ethics in Islamic Economic System

Environmental ethics play a crucial role in the Islamic economic system, emphasizing the importance of sustainable practices and stewardship of the natural world. The concept of stewardship, known as 'Khalifah' in Islam, highlights the responsibility...

Read more →

Comparison of Islamic and Conventional Economic Systems

Within the conventional economic system, the notion of economic justice is often delineated by principles that aim to maintain a level playing field for all members of society. This entails implementing policies and regulations that seek to uphold fa...

Read more →

Islamic Asset Management in the Age of ESG Investing

In the realm of Islamic asset management, a notable innovation has been the integration of Environmental, Social, and Governance (ESG) principles into investment strategies. This holistic approach seeks to align financial gains with ethical and susta...

Read more →

Role of Islamic Endowments in Asset Management

In the domain of Islamic endowment fund management, innovation plays a pivotal role in enhancing financial prosperity and sustainability. By adopting forward-thinking strategies and embracing technological advancements, endowment funds can achieve gr...

Read more →

Islamic Financial Planning and Wealth Preservation

Planning for retirement is a crucial aspect of financial management in Islam, with a strong emphasis on ensuring financial security in the later years through halal investments. Islamic retirement planning focuses on responsibly managing wealth to ma...

Read more →

Islamic Socially Responsible Investing

As Islamic Socially Responsible Investing continues to gain traction globally, there is a noticeable shift towards ethical and sustainable investment practices among Muslim investors. This trend reflects a growing emphasis on aligning financial decis...

Read more →

Compliance and Auditing in Islamic Asset Management

Islamic financial institutions face unique compliance challenges that stem from the need to adhere to Shariah principles while also meeting regulatory requirements. One of the key challenges is the interpretation and application of Shariah law in a r...

Read more →

Family Office Services in Islamic Finance

Managing risk is a crucial aspect of operating a family office in the realm of Islamic finance. Given the unique principles and guidelines set by Shariah law, family offices must adopt tailored risk management strategies to safeguard investments and ...

Read more →

Role of Zakat in Islamic Wealth Management

Zakat holds a significant place in Islamic wealth management, especially in the realm of investment and business practices. It serves as a fundamental pillar of Islamic finance, emphasizing social responsibility and fair distribution of wealth. In th...

Read more →

Sustainable Investing in Islamic Asset Management

The growth of sustainable investing in Islamic finance has been steadily on the rise in recent years, reflecting a shifting mindset towards ethical and responsible investment practices within the Islamic asset management industry. Investors are incre...

Read more →

Corporate Governance in Islamic Finance

Ethical standards play a fundamental role in shaping corporate governance within the Islamic finance sector. These standards are deeply rooted in the principles of Sharia law, emphasizing honesty, fairness, and accountability in all financial dealing...

Read more →

Global Trends in Islamic Asset Management

The Islamic asset management industry faces several challenges that hinder its growth and wider acceptance in the global financial market. One of the major challenges is the lack of standardization and harmonization in Shariah interpretation among sc...

Read more →

Sukuk Investment Strategies in Islamic Asset Management

Sukuk issuance process involves a series of steps that are crucial for the successful issuance of Islamic bonds. Firstly, the issuer, which can be a government, corporation, or financial institution, needs to determine the purpose and structure of th...

Read more →

Commodity Trading in Islamic Finance

The legal framework for commodity trading in Islamic finance plays a crucial role in ensuring that transactions adhere to Sharia principles. Islamic finance is guided by the principles of fairness, transparency, and ethical conduct. Thus, it is essen...

Read more →

Islamic Private Equity and Venture Capital

Islamic private equity investments offer a diverse range of opportunities for investors adhering to Shariah principles. One common type of investment in Islamic private equity is known as Musharakah, where partners jointly contribute capital to a pro...

Read more →

Fixed Income Instruments in Shariah-Compliant Asset Management

A fundamental aspect of Shariah-compliant asset management is the screening process applied to fixed income instruments. This process involves a thorough examination to ensure compliance with Islamic principles, thereby offering investors a way to pa...

Read more →

Equity Investments in Islamic Finance

When evaluating the performance of equity investments in Islamic finance, it is essential to consider a range of metrics that align with Shariah principles. Common performance measures include return on investment (ROI), earnings per share (EPS), pri...

Read more →

Portfolio Diversification in Islamic Finance

Portfolio diversification within Islamic finance presents unique challenges and considerations that require careful navigation by investors and financial advisors. One primary challenge stems from the limitations imposed by Sharia principles on certa...

Read more →

Ethical Considerations in Islamic Asset Management

Islamic asset management is governed by a strict compliance and regulatory framework that ensures all investment activities adhere to Islamic principles and values. The regulatory framework encompasses guidelines set forth by Sharia law, which serve ...

Read more →

Technology and Digital Transformation in Islamic Asset Management

Mobile applications have revolutionised the landscape of Islamic wealth management, offering convenient and accessible solutions for investors seeking Sharia-compliant investment opportunities. With the rise of fintech innovations, these mobile platf...

Read more →

Wealth Management in Islamic Finance

Islamic estate planning is a crucial aspect of Islamic wealth management, ensuring that assets are distributed in accordance with Islamic inheritance laws. This involves meticulous planning to allocate inheritances among beneficiaries based on specif...

Read more →

Real Estate Investment in Islamic Asset Management

The global Islamic real estate investment market continues to show promising growth trends, with an increasing number of investors seeking sharia-compliant opportunities. This surge in interest can be attributed to the strong performance of halal pro...

Read more →

Innovation in Islamic Asset Management

Market trends in Islamic asset management are showing promising growth, with a noticeable rise in interest from both individual and institutional investors. The demand for Sharia-compliant investment products has been on the uptick, reflecting a grow...

Read more →

Regulatory Framework for Islamic Asset Management

The governance structure in Islamic investment firms adheres to the principles of transparency and accountability to ensure ethical practices are maintained. Boards of directors play a crucial role in overseeing the firm's operations and strategic de...

Read more →

Asset Allocation in Islamic Finance

Implementing asset allocation according to Sharia principles presents a unique set of challenges for investors in the Islamic finance industry. One key obstacle is the limited availability of Sharia-compliant investment opportunities that meet the sp...

Read more →

Risk Management in Islamic Asset Management

Compliance risks in Islamic finance are paramount due to the stringent adherence required to Islamic laws and regulations. It is imperative for Islamic asset management firms to ensure that their investment strategies and practices comply with Sharia...

Read more →

Challenges and Opportunities in Islamic Asset Management

Ethical investing plays a pivotal role in Islamic asset management, acting as a guiding principle for investment decisions. In the context of Islamic finance, ethical considerations are rooted in Sharia principles, which prohibit investments in secto...

Read more →

Performance Metrics for Islamic Asset Management

The monitoring and reporting framework is a crucial aspect of Islamic asset management, ensuring transparency, accountability, and compliance with Sharia principles. Through regular monitoring, fund managers can track the performance of Islamic portf...

Read more →

Role of Asset Managers in Islamic Finance

Performance evaluation in Islamic finance plays a crucial role in assessing the effectiveness and efficiency of asset managers in aligning with Sharia principles. Islamic finance not only focuses on financial performance but also emphasizes ethical c...

Read more →

Types of Assets Managed in Islamic Finance

Asset managers play a crucial role in the realm of Islamic finance by overseeing the management and growth of assets in accordance with Sharia principles. Their primary responsibility involves ensuring that investments comply with Islamic teachings a...

Read more →

Shariah-Compliant Investment Strategies in Asset Management

To effectively navigate the realm of asset management from a Shariah-compliant perspective, it is paramount to strike a harmonious balance between upholding ethical values and achieving financial objectives. This delicate equilibrium calls for a meti...

Read more →

Islamic Exchange-Traded Funds (I-ETFs)

Islamic Exchange-Traded Funds (I-ETFs) present a promising avenue for investors seeking exposure to Sharia-compliant assets. With the global Islamic finance industry on the rise, I-ETFs offer a unique opportunity for diversification within a framewor...

Read more →

Islamic Real Estate Investment Trusts (I-REITs)

When analyzing Islamic Real Estate Investment Trusts (I-REITs), it is essential to consider various performance metrics to gauge their financial health and potential returns. One of the key metrics used in I-REIT analysis is the Net Asset Value (NAV)...

Read more →

Rahn Sukuk (Pawning sukuk)

Rahn Sukuk, also known as Pawning Sukuk, is gaining traction in the Islamic finance market due to its compliance with Sharia principles and regulations. Islamic finance emphasizes ethical and moral practices, prohibiting elements such as interest (ri...

Read more →

Waqf Sukuk (Endowment sukuk)

Investment in Waqf Sukuk presents a unique opportunity for ethical investors seeking both financial returns and social impact. These Islamic endowment-linked securities provide a way to support charitable causes while earning a steady stream of incom...

Read more →

Istithmar Sukuk (Investment sukuk)

When comparing Istithmar Sukuk to other investment options available in the market, it is essential to highlight its unique features and benefits. Istithmar Sukuk, as an investment vehicle, offers investors the opportunity to participate in Sharia-co...

Read more →

Asset-Backed Sukuk (Secured by assets)

Factors influencing the performance of Asset-Backed Sukuk are crucial to consider for investors seeking stable returns. The underlying assets securing the Sukuk play a significant role in determining its performance. These assets can range from prope...

Read more →

Corporate Sukuk (Issued by corporations)

Corporate Sukuk and conventional bonds are two prominent investment instruments in the financial markets. While both serve as means for corporations to raise capital, they differ in their underlying structures and principles. Sukuk, being Islamic fin...

Read more →

Sovereign Sukuk (Government-issued sukuk)

The regulatory framework for sovereign sukuk is a pivotal aspect that governs the issuance and trading of these government-issued Islamic financial instruments. In accordance with Islamic principles, regulatory authorities ensure that the structuring...

Read more →

Hybrid Sukuk (Mixed structure sukuk)

Market trends in hybrid sukuk demonstrate a growing appetite for innovative Islamic finance solutions in the global market. Investors are increasingly seeking diversification and higher yields, leading to a surge in the issuance of hybrid sukuk instr...

Read more →

Sukuk al-Salam (Deferred delivery sukuk)

Investing in Sukuk al-Salam provides unique opportunities for investors seeking Sharia-compliant investment options. These sukuk offer a way to participate in the market while adhering to Islamic principles. By engaging in Sukuk al-Salam, investors c...

Read more →

Sukuk al-Wakalah (Agency sukuk)

The regulatory framework governing Sukuk al-Wakalah, also known as Agency Sukuk, plays a crucial role in ensuring compliance with Islamic finance principles. In Australia, the regulatory guidelines set by regulatory bodies such as the Australian Secu...

Read more →

Sukuk al-Istisna (Manufacturing sukuk)

Manufacturing sukuk, also known as Sukuk al-Istisna, differ from other sukuk structures in several key ways. One of the main distinctions lies in the nature of the underlying assets. While other types of sukuk are typically backed by tangible assets ...

Read more →

Sukuk al-Murabaha (Cost-plus sukuk)

Sukuk al-Murabaha, also known as Cost-plus sukuk, follows a structured issuance process that involves several key steps. Firstly, the issuer, typically a corporate entity or government, identifies the need for financing and decides to issue sukuk al-...

Read more →

Sukuk al-Musharakah (Partnership sukuk)

The legal framework governing Sukuk al-Musharakah plays a crucial role in ensuring the compliance and legitimacy of these partnership-based sukuk instruments. In Islamic finance, adherence to Sharia principles is paramount, and as such, the legal str...

Read more →

Sukuk al-Mudarabah (Profit-sharing sukuk)

The regulatory framework for Sukuk al-Mudarabah plays a crucial role in ensuring compliance and transparency in profit-sharing sukuk transactions. In Australia, these guidelines are established by regulatory bodies to safeguard the interests of inves...

Read more →

Sukuk al-Ijarah (Lease-based sukuk)

Investing in Sukuk al-Ijarah, like any other financial instrument, comes with its own set of risks that investors need to be mindful of. One of the primary risk factors associated with Sukuk al-Ijarah is the credit risk posed by the issuer. As these ...

Read more →

Qard al-Hasan (Benevolent loan)

In the realm of Islamic finance, Qard al-Hasan stands out as a noble concept that embodies the principles of benevolence and mutual support within the community. This benevolent loan is distinguished by the absence of any interest or profit, reflecti...

Read more →

Wadiah (Safekeeping)

Wadiah, Mudarabah, and Musharakah are different types of contracts used in Islamic banking. While Wadiah involves the safekeeping of funds without any return to the depositor, Mudarabah and Musharakah are profit-sharing contracts. In Mudarabah, one p...

Read more →

Rahn (Pawning)

Rahn, also known as pawning, and traditional loans are two distinct financial mechanisms that individuals in Australia often consider for urgent financial needs. Rahn involves pledging a valuable item, such as jewelry or electronics, as collateral fo...

Read more →

Hawala (Transfer of debt)

When comparing hawala and traditional banking, it becomes evident that these two systems operate on vastly different principles. Hawala is a system based on trust, relationships, and informal agreements, whereas traditional banking follows strict reg...

Read more →

Kafalah (Guarantee)

Kafalah, a cornerstone of Islamic finance, holds significant importance in facilitating transactions while adhering to Sharia principles. The concept of kafalah, rooted in mutual cooperation and solidarity, plays a crucial role in the Islamic finance...

Read more →

Wakalah (Agency agreements)

Wakalah agreements hold significant legal implications that must not be overlooked. Understanding the legal framework surrounding Wakalah is crucial in ensuring smooth transactions. These agreements entail a principal-agent relationship, where the pr...

Read more →

Tawarruq (Reverse murabaha)

There are several risks associated with Tawarruq that need to be carefully considered by financial institutions and participants. One significant risk is the potential for price manipulation, where parties involved in the transaction may collude to a...

Read more →

Istisna'a-Ijara (Construction financing)

In Istisna'a-Ijara contracts, the legal framework plays a crucial role in ensuring the rights and obligations of all parties involved in the construction financing agreement. Islamic finance principles dictate that the contracts must comply with Shar...

Read more →

Istisna (Manufacturing contracts)

Risk management plays a crucial role in Istisna agreements to ensure smooth execution of manufacturing contracts. It involves identifying potential risks that could impact the project timeline, quality, or cost. Stakeholders must conduct thorough ris...

Read more →

Salam (Deferred delivery sale)

In Australia, the legal framework for Salam transactions is established to provide guidelines and regulations for such Islamic finance contracts. The framework ensures that Salam agreements comply with the relevant laws and regulations in the country...

Read more →

Ijarah (Leasing)

Ijarah transactions, like any other financial dealings, come with inherent risks that individuals and businesses should be aware of. One notable risk is the possibility of lessees defaulting on their lease payments, leading to financial losses for le...

Read more →

Murabaha (Cost-plus financing)

When engaging in Murabaha transactions, there are several risks that individuals and institutions need to be aware of. One of the primary risks associated with Murabaha is the possibility of price fluctuations. Since the cost-plus financing model rel...

Read more →

Shariah Compliance and Digital Transformation in Islamic Finance

When integrating technology in Shariah-compliant finance, it is essential to ensure that the digital solutions adhere to the principles of Islamic finance. One best practice is to collaborate with Shariah scholars and experts to develop and review di...

Read more →

Shariah Compliance and Regulatory Framework in Islamic Finance

Shariah Board plays a crucial role in the Islamic finance industry, ensuring that financial products and services comply with Shariah principles. The primary function of a Shariah Board is to provide guidance and supervision to financial institutions...

Read more →

Shariah Compliance and Innovation in Islamic Financial Products

Implementing Shariah compliance in the realm of financial products presents a myriad of challenges that require careful consideration and expertise. One key obstacle is the interpretation and application of Islamic law, which can vary among scholars ...

Read more →

Shariah Compliance and Risk Management in Islamic Finance

Mitigating risks through ethical investment practices is a fundamental aspect of ensuring the stability and sustainability of Islamic finance. By adhering to Shariah principles and guidelines, financial institutions can avoid engaging in activities t...

Read more →

Shariah Compliance and Financial Stability in Islamic Finance

One of the primary challenges in the realm of Islamic finance revolves around the meticulous adherence to Shariah principles. Ensuring Shariah compliance necessitates a comprehensive understanding of Islamic law, which can be intricate and subject to...

Read more →

Shariah Compliance and Financial Inclusion in Islamic Finance

In the realm of Shariah-compliant banking, innovation and technology have become essential driving forces propelling the industry forward. These modern advancements are not only revolutionizing banking practices but also ensuring that financial insti...

Read more →

Shariah Compliance Due Diligence in Islamic Finance Transactions

The legal framework for Shariah compliance in Islamic finance transactions is essential to ensure the adherence to Islamic principles and ethical standards. Islamic finance operates under the guidance of Shariah law, which prohibits certain elements ...

Read more →

Shariah Compliance and Socially Responsible Investing in Islamic Finance

Promoting transparency and accountability in socially responsible investing is a crucial aspect of ensuring ethical financial practices within Islamic finance. By upholding these principles, Islamic financial institutions can build trust with their s...

Read more →

Shariah Compliance in Islamic Trade Finance

Shariah-compliant trade finance has significantly impacted the global financial landscape, gaining momentum as a niche market catering to the needs of Islamic businesses and investors worldwide. By adhering to Islamic principles such as the prohibiti...

Read more →

Shariah Compliance Framework for Islamic Real Estate Investments

When evaluating the performance of Shariah-compliant real estate investments, it is imperative to consider a range of factors that align with Islamic principles. One key aspect is the financial performance of the investment, which should be measured ...

Read more →

Shariah Compliance in Islamic Wealth Management

Islamic wealth management relies heavily on the guidance and expertise of Shariah scholars to ensure compliance with Islamic principles and values. These scholars play a vital role in overseeing financial transactions, investment products, and wealth...

Read more →

Shariah Compliance and Corporate Governance in Islamic Finance

Shariah compliance in Islamic finance plays a pivotal role in upholding ethical business practices within the industry. The adherence to Shariah principles ensures that financial transactions are conducted in a manner that is not only legally complia...

Read more →

Shariah Compliance Software Solutions for Islamic Finance

Compliance monitoring and reporting tools play a crucial role in ensuring Islamic financial institutions adhere to Shariah principles. These software solutions provide real-time monitoring of transactions, contracts, and investments to identify any p...

Read more →

Shariah Compliance Regulations for Islamic Financial Markets

Implementing Shariah compliance in Islamic financial markets poses several challenges for financial institutions and regulators. One major obstacle is the lack of universal standards and interpretations of Islamic law across different jurisdictions. ...

Read more →

Shariah Compliance Reporting in Islamic Financial Institutions

The impact of Shariah compliance reporting on stakeholders in Islamic financial institutions is significant. Stakeholders, including investors, regulators, and the wider community, rely heavily on these reports to assess the institution's adherence t...

Read more →

Shariah Compliance and Ethical Standards in Islamic Finance

The regulatory landscape for Shariah compliance in Islamic finance is constantly evolving to ensure adherence to ethical standards and principles. Regulatory bodies play a crucial role in overseeing financial institutions to uphold Shariah principles...

Read more →

Shariah Compliance Best Practices in Islamic Finance

Training and education on Shariah compliance are essential components for individuals working in the Islamic finance industry. It is imperative for employees to have a deep understanding of Shariah principles to ensure that all financial transactions...

Read more →

Ensuring Shariah Compliance in Islamic Asset Management

Shariah compliance plays a pivotal role in the performance of Islamic asset management. Investors who adhere to Shariah principles seek financial growth while ensuring ethical and religious alignment in their investments. This dual objective requires...

Read more →

Shariah Compliance Training for Islamic Finance Professionals

Islamic finance professionals encounter a myriad of challenges when it comes to ensuring Shariah compliance within their financial practices. One significant hurdle they face is the intricate nature of interpreting Shariah principles. The diverse int...

Read more →

Shariah Compliance Certification for Islamic Financial Products

Regulatory bodies play a crucial role in ensuring that Islamic financial products adhere to Shariah principles. These bodies are responsible for setting and enforcing the guidelines that govern the structuring and operations of Islamic financial inst...

Read more →

Shariah Compliance Monitoring in Islamic Finance

Training and development for Shariah compliance professionals is vital to ensure a deep understanding of Islamic finance principles and regulations. Continuous education programs play a crucial role in equipping professionals with the necessary knowl...

Read more →

Shariah Compliance Practices in Islamic Microfinance

Shariah Advisory Boards play a crucial role in ensuring that Islamic microfinance institutions comply with Shariah principles. Their primary function is to provide expert guidance on matters related to Shariah compliance, ensuring that all financial ...

Read more →

Shariah Compliance Framework for Takaful Operations

Best practices for ensuring Shariah compliance in Takaful operations are crucial to uphold the ethical and religious principles governing Islamic finance. These practices serve as guiding principles to ensure that Takaful products and services align ...

Read more →

Shariah Compliance Guidelines for Sukuk Issuance

Monitoring and reporting Shariah compliance is a critical aspect of Sukuk issuance. It ensures that the Sukuk structure and transactions adhere strictly to Islamic principles and guidelines. Effective monitoring mechanisms help in upholding transpare...

Read more →

Shariah Compliance Standards for Islamic Investment Funds

Risk management is a crucial aspect of Shariah-compliant investment funds, ensuring that the funds adhere to Islamic principles while also minimizing risks. One of the key strategies in managing risk in Islamic investment funds is diversification, sp...

Read more →

Shariah Compliance Challenges in Islamic Banking

Governance and oversight play a crucial role in ensuring the adherence of Islamic banking institutions to Shariah principles. The board of directors and management must work in harmony to establish robust governance structures that promote transparen...

Read more →

Shariah Compliance Requirements for Islamic Financial Institutions

Building strong client relations and effective communication are vital aspects for Islamic financial institutions to uphold Shariah compliance requirements. These institutions must prioritize maintaining transparent and open channels of communication...

Read more →

Shariah Governance Framework in Islamic Finance

Regulatory bodies play a crucial role in ensuring the adherence of Islamic financial institutions to Shariah principles. In Australia, the regulatory landscape for Shariah compliance is overseen by entities such as the Australian Prudential Regulatio...

Read more →

Shariah Compliance Auditing in Islamic Finance

Shariah compliance auditing is a crucial aspect of Islamic finance to ensure adherence to principles and guidelines outlined in Islamic law. Best practices in Shariah compliance auditing involve a meticulous review of financial transactions, contract...

Read more →

Shariah Screening Process in Islamic Investments

Islamic investments adhere to strict Shariah principles, which can present challenges in the screening process. One significant challenge is the lack of standardization across various Shariah boards, leading to inconsistencies in interpreting Islamic...

Read more →

Islamic Microfinance and Islamic Asset Management

Diversifying portfolios is a pivotal aspect of Islamic asset management, enabling investors to spread risk across various asset classes while adhering to Sharia principles. In the context of Islamic finance, diversification entails investing in a ran...

Read more →

Islamic Microfinance and Islamic Investment Funds

Islamic investment funds have been gaining traction in the global market, offering investors an alternative to conventional investment options. Evaluating the performance of Islamic investment funds is essential to assess their success and attractive...

Read more →

Islamic Microfinance and Sukuk

Islamic microfinance faces a range of challenges that hinder its growth and impact in the financial sector. One major obstacle is the lack of awareness and understanding among both clients and financial institutions. Many potential borrowers are unaw...

Read more →

Islamic Microfinance and Takaful

Takaful operators encounter various challenges in the complex landscape of Islamic finance. One significant issue is the lack of awareness and understanding among potential customers about the principles and benefits of Takaful. This poses a hurdle i...

Read more →

Islamic Microfinance and Islamic Banking

Participating in Islamic microfinance offers a range of benefits for individuals and communities seeking financial assistance in a way that aligns with Islamic principles. One key advantage is the opportunity to access much-needed funding without inv...

Read more →

Islamic Microfinance and Community Development

Income generation and poverty alleviation are the main goals of successful Islamic microfinance projects. In Indonesia, the Baitul Maal Wat Tamwil (BMT) model has been instrumental in empowering rural communities. By providing interest-free loans to ...

Read more →

Islamic Microfinance and Social Impact

Islamic microfinance and conventional microfinance are two distinct financial systems that serve different segments of society. Islamic microfinance, based on Sharia principles, prioritizes social welfare and financial inclusion while conforming to I...

Read more →

Future Trends in Islamic Microfinance

Risk management plays a crucial role in ensuring the sustainability and success of Islamic microfinance institutions. It involves identifying, assessing, and mitigating potential risks that could impact the financial stability of the institution and ...

Read more →

Islamic Microfinance and Economic Growth

Technology has emerged as a powerful enabler in the realm of Islamic microfinance, shaping the landscape and enhancing the efficiency of financial services. With the advent of digital platforms, fintech solutions have provided a gateway to financial ...

Read more →

Islamic Microfinance in Non-Islamic Countries

Technology has become a vital tool in advancing Islamic microfinance initiatives around the world. By leveraging digital solutions, financial institutions are able to reach a wider audience and provide more accessible financial services to those in n...

Read more →

Islamic Microfinance in Islamic Countries

The integration of technology in Islamic microfinance has revolutionized the way financial services are delivered to underserved communities in Islamic countries. Fintech solutions have played a pivotal role in enhancing access to financial resources...

Read more →

Islamic Microfinance and Entrepreneurship

Islamic microfinance plays a pivotal role in providing financial assistance to individuals who are unable to access traditional banking services due to religious reasons. One of the key contributors to the sustainability of Islamic microfinance is th...

Read more →

Islamic Microfinance for Rural Development

Building sustainable partnerships in rural Islamic microfinance is critical for the long-term success and impact of financial initiatives in underserved communities. By collaborating closely with local stakeholders such as community leaders, NGOs, an...

Read more →

Islamic Microfinance and Financial Inclusion

Islamic microfinance has been instrumental in uplifting individuals and communities by providing them with access to financial services that comply with Islamic principles. One noteworthy success story is the case of Fatima, a young entrepreneur in I...

Read more →

Risk Management in Islamic Microfinance

Effective risk management is crucial for the success and sustainability of Islamic microfinance institutions. One of the best practices in this regard is the establishment of robust internal control mechanisms. These mechanisms help in identifying, a...

Read more →

Islamic Microfinance for Women Empowerment

There are countless inspiring success stories of women whose lives have been transformed through Islamic microfinance initiatives. One such tale is that of Aisha, a single mother who used a small loan from an Islamic financial institution to start he...

Read more →

Islamic Microfinance and Sustainable Development Goals

The Islamic microfinance sector faces several challenges and opportunities in its quest to contribute to sustainable development goals. One of the major challenges is the lack of standardized regulatory frameworks that are tailored to the unique char...

Read more →

Technology and Innovation in Islamic Microfinance

Collaboration between Islamic microfinance institutions and tech companies has become increasingly prevalent in recent years, revolutionising the way financial services are delivered to underserved communities. By joining forces, these entities aim t...

Read more →

Shariah Compliance in Islamic Microfinance

The regulatory framework for Shariah compliance in Islamic microfinance plays a crucial role in ensuring the adherence to Islamic principles and values. It provides a set of guidelines and standards that govern the operations of microfinance institut...

Read more →

Regulatory Framework for Islamic Microfinance

Regulatory authorities play a vital role in ensuring the stability and soundness of the Islamic microfinance sector. Through the implementation of robust regulatory frameworks, these authorities aim to safeguard the interests of all stakeholders invo...

Read more →

Islamic Microfinance Products and Services

Islamic microfinance institutions play a pivotal role in providing financial services that are compliant with Sharia laws. By ensuring that transactions are free from interest (riba) and uncertainty (gharar), these institutions create a platform for ...

Read more →

Islamic Microfinance Models

Islamic microfinance models offer a unique approach to financial services, distinctly different from conventional microfinance systems. While both aim to provide financial inclusion to low-income individuals, Islamic microfinance operates within the ...

Read more →

Case Studies in Islamic Microfinance

Sharia compliance is at the core of Islamic microfinance, ensuring that financial activities adhere to Islamic principles. This fundamental aspect differentiates Islamic microfinance institutions from conventional financial institutions. By upholding...

Read more →

Islamic Microfinance Institutions around the World

Islamic microfinance institutions have been playing a significant role in Africa, particularly in empowering individuals and communities to break the cycle of poverty. By providing access to interest-free financial services and promoting ethical busi...

Read more →

Best Practices in Islamic Microfinance

Across various countries, successful Islamic microfinance projects have demonstrated the positive impact of Sharia-compliant financial services in uplifting communities from poverty. One notable case study is the Al Amana Microfinance in Morocco, whi...

Read more →

Challenges in Islamic Microfinance

In the realm of Islamic microfinance, the utilization of technological solutions has emerged as a vital tool for enhancing and expanding financial services. The integration of digital banking platforms has revolutionized the accessibility and efficie...

Read more →

Impact of Islamic Microfinance on Poverty Alleviation

Islamic microfinance has been making significant strides in poverty alleviation, with numerous success stories exemplifying its effectiveness. One such inspiring tale comes from a small village in Indonesia where a group of women banded together to s...

Read more →

Comparison between Islamic Microfinance and Conventional Microfinance

Impact assessment is a crucial aspect of evaluating the effectiveness of conventional microfinance initiatives. It involves measuring the outcomes and effects of these programs on the targeted beneficiaries, mainly individuals from low-income backgro...

Read more →

Role of Zakat in Islamic Microfinance

Zakat embodies a fundamental pillar of Islamic faith that not only encourages charitable giving but also serves as a powerful tool for wealth redistribution within society. By obligating the affluent members of the community to donate a portion of th...

Read more →

Principles of Islamic Microfinance

Islamic microfinance plays a pivotal role in uplifting underprivileged communities by providing them with access to financial resources that adhere to Islamic principles. This empowers individuals to become self-sufficient and improve their economic ...

Read more →

-- Takaful Research and Development

Takaful initiatives have been instrumental in fostering positive social impact within communities around the world. By promoting the values of solidarity and mutual support, Takaful programs have helped bridge the gap between economic disparities, pr...

Read more →

-- Takaful Industry Associations

Supporting research and development in Takaful practices is a crucial aspect for the continuous growth and enhancement of the industry. Takaful industry associations play a pivotal role in fostering a culture of innovation and knowledge creation with...

Read more →

-- Takaful Supervision

Technology plays a pivotal role in enhancing regulatory compliance within the Takaful industry. In Australia, the adoption of advanced technological solutions has revolutionized the way Takaful companies adhere to regulatory standards. By leveraging ...

Read more →

-- Takaful and Sustainable Development

The Takaful industry faces a myriad of challenges that impede its growth and development. One of the prominent issues is the lack of awareness among potential customers regarding Islamic insurance principles. This poses a hindrance to increasing mark...

Read more →

-- Takaful Technology Integration

With the evolving landscape of the takaful industry, regulatory compliance has become a critical focus for takaful operators. As technology continues to reshape the way businesses operate, integrating takaful technology has been instrumental in enhan...

Read more →

-- Takaful Regulatory Framework

Sharia compliance is the cornerstone of Takaful operations, ensuring that all insurance activities are conducted in adherence to Islamic principles. This fundamental requirement dictates that Takaful products and services must be free from any elemen...

Read more →

-- Takaful and Economic Growth

The Takaful market has shown substantial growth in recent years, reflecting a rising demand for Islamic insurance products worldwide. This upward trend is largely driven by increasing awareness and acceptance of Takaful as a viable alternative to con...

Read more →

-- Takaful and Global Financial Stability

In the realm of Takaful, advancements in technology are reshaping the landscape of insurance solutions. The integration of innovative technologies not only streamlines processes but also enhances the overall customer experience, fostering stronger en...

Read more →

-- Takaful Consumer Protection

Educating Takaful consumers is fundamental in empowering them to make informed decisions regarding their insurance needs. One of the primary objectives of education in the Takaful industry is to enhance consumers' understanding of the underlying prin...

Read more →

-- Takaful and Financial Inclusion

Technology plays a pivotal role in propelling the accessibility and efficiency of Takaful services, ultimately fostering financial inclusion. Through the integration of innovative digital solutions, Takaful providers can streamline operations, enhanc...

Read more →

-- Takaful Ethics

Handling ethical dilemmas in Takaful requires a nuanced approach that prioritizes the values of fairness, integrity, and transparency. When faced with complex ethical challenges, Takaful operators must uphold the principles of Shariah while also adhe...

Read more →

-- Takaful Innovation

Technological integration has revolutionized Takaful operations, bringing about efficiency and convenience in serving participants. By embracing advanced digital systems and software solutions, Takaful companies can enhance their service quality and ...

Read more →

-- Takaful Future Outlook

The Takaful sector presents promising investment opportunities for individuals and institutions seeking to align their financial endeavors with ethical and Shariah-compliant principles. With the growing demand for Takaful products globally, there is ...

Read more →

-- Takaful Growth Prospects

Digital transformation is revolutionising the Takaful industry, reshaping traditional business models and enhancing customer experiences. Technology plays a pivotal role in streamlining operations, improving efficiency, and expanding reach. With digi...

Read more →

-- Takaful Case Studies

For Takaful Case Study 6, we delve into the intricacies of regulatory compliance and the governance framework that oversees Takaful operations. This case study highlights the critical importance of adhering to regulatory guidelines and maintaining ro...

Read more →

-- Takaful Market Trends

The implementation of robust risk management strategies is paramount for the sustainable growth of Takaful operations. Takaful providers in Australia are increasingly focusing on enhancing their risk management frameworks to address the unique challe...

Read more →

-- Takaful Compliance with Shariah

Regulatory compliance forms the cornerstone of the Takaful industry, ensuring that all operations are conducted in alignment with Shariah principles and regulatory requirements. Takaful operators are bound by stringent guidelines set forth by regulat...

Read more →

-- Takaful Opportunities

Marketing strategies for Takaful services play a crucial role in attracting potential customers and creating brand awareness in the market. Leveraging various communication channels such as social media, email marketing, and traditional advertising c...

Read more →

-- Takaful Challenges

Operational efficiency is a critical aspect for Takaful providers to ensure smooth operations and optimal performance. By streamlining processes and enhancing internal systems, Takaful companies can boost their productivity and deliver better service...

Read more →

-- Takaful and Conventional Insurance Comparison

Investment practices play a crucial role in shaping the financial strategies of both Takaful and conventional insurance companies. In Takaful, investments must align with Islamic principles, avoiding interest-based transactions, speculation, and unet...

Read more →

-- Takaful Governance

The integration of technology and innovation in takaful governance is revolutionising the way ethical insurance operates. By leveraging digital platforms, takaful providers are enhancing their operational efficiency and customer experience. This shif...

Read more →

-- Takaful Risk Management

Implementing Takaful risk management comes with its own set of challenges that require meticulous attention and strategic planning. One of the primary hurdles faced in this realm is the complexity of blending conventional insurance practices with Isl...

Read more →

-- Takaful Investment Practices

Takaful investment strategies are pivotal for ensuring the growth and sustainability of Takaful funds. These strategies involve careful planning and decision-making to allocate assets effectively. Takaful companies typically aim to balance risk and r...

Read more →

-- Takaful Claims Management

One common reason for the rejection of Takaful claims is the lack of accurate and complete supporting documentation. When submitting a claim, it is crucial to ensure that all necessary paperwork is provided to avoid delays or rejection. Incomplete in...

Read more →

-- Takaful Distribution Channels

Corporate partnerships play a significant role in the distribution of Takaful products, allowing insurers to tap into existing networks and reach a broader audience. By collaborating with corporations, Takaful providers can leverage the credibility a...

Read more →

-- Takaful Products

When considering Takaful investment options, there are several avenues to explore in the market. These investment-linked Takaful plans offer individuals the opportunity to grow their wealth while ensuring it is in line with their ethical beliefs and ...

Read more →

-- Takaful Contributions

Takaful contributions differ significantly from conventional insurance premiums. In takaful, participants contribute to a common pool to support each other in times of need, reflecting a sense of community and mutual cooperation. Contrary to this app...

Read more →

-- Takaful Regulations

Industry associations play a crucial role in advocating for regulatory frameworks that support the growth and development of the Takaful industry in Australia. These associations act as the voice of the Takaful providers, working closely with regulat...

Read more →

-- Takaful Operators

Takaful operators have a promising path ahead with substantial growth opportunities on the horizon. One significant avenue for expansion lies in tapping into emerging markets where there is a rising demand for ethical financial solutions. By strategi...

Read more →

Sukuk Market Forecast

In recent times, the Sukuk market has witnessed a surge in innovative practices aimed at enhancing accessibility and attractiveness to a wider investor base. Embracing digital platforms and blockchain technology has been a game-changer, streamlining ...

Read more →

-- Takaful Models

The Takaful industry is encountering various challenges that require thoughtful consideration and strategic solutions. One of the primary challenges faced by Takaful operators is the lack of awareness and understanding among potential customers regar...

Read more →

Sukuk Market Returns

The regulatory environment for Sukuk investments in Australia plays a crucial role in ensuring the growth and stability of the market. Regulators such as the Australian Securities and Investments Commission (ASIC) are actively involved in setting gui...

Read more →

Sukuk Market Instruments

The regulatory framework for Sukuk plays a crucial role in ensuring the integrity and transparency of the Sukuk market. In Australia, the regulatory framework for Sukuk is guided by the Australian Securities and Investments Commission (ASIC) and the ...

Read more →

Sukuk Market Structure

The Sukuk market is poised for significant growth in the coming years, driven by increasing demand for Sharia-compliant investment opportunities. With the global Islamic finance industry expanding rapidly, there is a growing appetite for Sukuk issuan...

Read more →

Sukuk Market Pricing

Yield calculations play a crucial role in determining the pricing of Sukuk in the market. Investors closely monitor yields to assess the profitability of their investments. It is essential to understand how yields are calculated to make informed deci...

Read more →

Sukuk Market Demand

The Sukuk market, also known as the Islamic bond market, is a rapidly growing sector attracting various key players. Among these players are sovereign entities, multinational corporations, financial institutions, and individual investors. These entit...

Read more →

Sukuk Market Supply

Investor sentiment towards Sukuk market supply plays a crucial role in shaping the overall dynamics of the Islamic finance industry. As investors assess the stability and growth potential of Sukuk offerings, their confidence in the market supply dire...

Read more →

Sukuk Market Innovation

Financial institutions play a pivotal role in the flourishing Sukuk market, acting as key facilitators for issuers and investors alike. Islamic banks, in particular, have been at the forefront of Sukuk issuance, leveraging their expertise in Sharia-c...

Read more →

Sukuk Market Compliance

Investing in Sukuk comes with various tax implications for investors in Australia. One key consideration is the treatment of profits earned from Sukuk investments. As per the Australian Taxation Office (ATO), these profits are often subject to taxati...

Read more →

Sukuk Market Resilience

Sukuk market faces several challenges that hinder its growth and development. One significant hurdle is the lack of harmonisation and standardisation across jurisdictions, resulting in complex legal structures and differing interpretations. This inco...

Read more →

Sukuk Market Development

As the Sukuk market continues to evolve, several future trends are expected to shape its development. One of the key trends is the increasing global demand for Islamic finance instruments, including Sukuk. This rise in demand is being driven by the g...

Read more →

Sukuk Market Participants

Legal entities involved in Sukuk issuance play a crucial role in the Islamic finance industry. These entities typically include corporations, special-purpose vehicles (SPVs), financial institutions, and government bodies. Each entity has its own uniq...

Read more →

Sukuk Market Size

The future of the Sukuk market looks promising as global demand for Islamic financial products continues to grow. With increasing interest from both Islamic and non-Islamic investors, the Sukuk market is expected to expand further in the coming years...

Read more →

Sukuk Market Liquidity

The future outlook for Sukuk market liquidity appears promising, with the market showing resilience and growth potential. As global interest in Islamic finance continues to rise, the Sukuk market is expected to attract more investors seeking Sharia-c...

Read more →

Regional Variations in Sukuk Issuance

Technological advancements have significantly reshaped the landscape of Sukuk issuance, bringing about greater efficiency and accessibility in the process. With the advent of digital platforms, issuers and investors can now engage in Sukuk transactio...

Read more →

Global Sukuk Issuance

The Sukuk market is facing several challenges that hinder its growth and development globally. One of the primary issues is the lack of standardization and harmonization in Sukuk structures and documentation. This inconsistency not only confuses inve...

Read more →

Sukuk Market Players

Rating agencies play a crucial role in the Sukuk market by providing investors with valuable insights into the creditworthiness and risk profile of Sukuk issuers. These agencies evaluate the financial health and stability of companies issuing Sukuk, ...

Read more →

Sukuk Market Performance

Investor sentiment in the Sukuk market plays a pivotal role in shaping the overall performance of Sukuk investments. The perception and confidence of investors in the market greatly influence the demand and supply dynamics, ultimately impacting the p...

Read more →

Sukuk Market Outlook

Innovations in Sukuk financing have been gaining traction in the global market. Market players are exploring new structures and mechanisms to enhance the appeal of Sukuk instruments to a broader investor base. One notable trend is the emergence of hy...

Read more →

Sukuk Market Challenges

When examining the investor sentiment towards the Sukuk market in Australia, it becomes evident that there is a growing interest and demand for Sharia-compliant investments. Investors are increasingly looking for opportunities to diversify their port...

Read more →

Sukuk Market Opportunities

Sukuk plays a crucial role in Islamic finance, providing a Sharia-compliant alternative to traditional interest-based bonds. As a form of Islamic financial instrument, Sukuk represents ownership of an asset or project, making it more aligned with Isl...

Read more →

Sukuk Market Growth

The Sukuk market is experiencing notable growth, driven by emerging trends that are shaping the landscape of Islamic finance. One such trend is the increasing popularity of Green Sukuk as a sustainable investment option. Investors are showing a growi...

Read more →

Sukuk Market Regulation

Regulatory reporting and disclosure requirements play a crucial role in ensuring transparency and accountability within the sukuk market. Issuers are obligated to adhere to strict guidelines set forth by regulatory bodies to provide investors with ac...

Read more →

Risks Associated with Sukuk Investments

Sukuk investments carry inherent liquidity risks that investors need to be mindful of. Unlike conventional bonds, Sukuk can have limited secondary market liquidity, making it challenging to sell the investment before maturity if needed. This illiquid...

Read more →

Benefits of Investing in Sukuk

Investing in Sukuk offers substantial benefits, one of which is capital preservation. Sukuk investments are structured to provide investors with a secure avenue to grow their wealth while safeguarding their invested capital. This feature makes Sukuk ...

Read more →

Sukuk Ratings and Credit Risk

Sukuk investments offer an attractive avenue for investors seeking Sharia-compliant opportunities, but they are not without their risks. Managing credit risk in Sukuk investments is a crucial aspect to consider in order to protect one's investment po...

Read more →

Role of Sukuk in Islamic Finance

Sukuk, as an integral part of Islamic finance, come with their own set of challenges and risks. One of the primary challenges associated with Sukuk lies in their complexity and structuring. Due to the requirement of adhering to Sharia principles, the...

Read more →

Sukuk Market Trends

The Sukuk market has witnessed significant technological advancements in recent years, transforming the way Islamic bonds are issued, traded, and managed. Digital Sukuk platforms have emerged as a key innovation, offering greater efficiency, transpar...

Read more →

Sukuk Issuance Process

Documentation requirements play a crucial role in the process of issuing Sukuk. The first key document needed is the issuance resolution from the board of directors, indicating the approval to proceed with the Sukuk issuance. This is essential as it ...

Read more →

Difference between Sukuk and Conventional Bonds

The issuance process for Sukuk and conventional bonds presents distinctive features that set them apart in the realm of financial instruments. Sukuk issuance involves the creation of Islamic securities compliant with Shariah principles, catering to i...

Read more →

Islamic Sovereign Wealth Funds

The regulatory framework for Islamic Sovereign Wealth Funds (SWFs) plays a crucial role in ensuring transparency, accountability, and compliance with Sharia principles. Islamic SWFs are subject to specific guidelines that govern their operations, inv...

Read more →

Impact Investing through Islamic Investment Funds

The regulatory environment for Islamic impact investing funds plays a crucial role in ensuring compliance with Sharia principles and financial regulations. In Australia, these funds are subject to rigorous oversight by regulatory bodies such as the A...

Read more →

Islamic Infrastructure Investment Funds