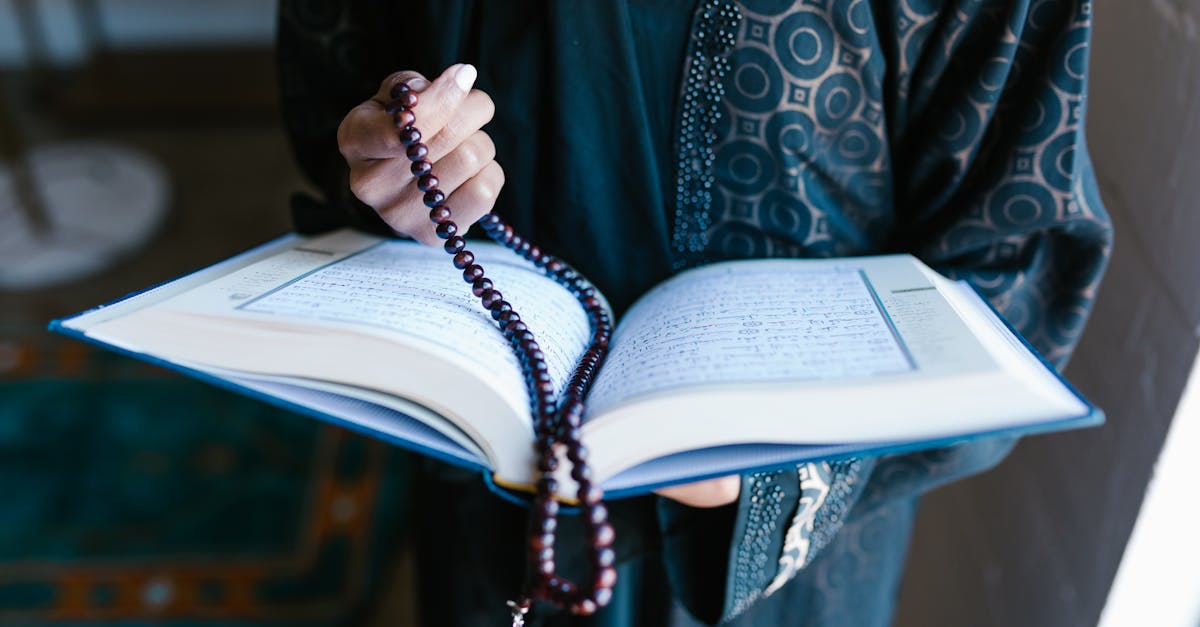

Role of Zakat in Islamic Wealth Management

Table Of Contents

Zakat in Investment and Business Practices

Zakat holds a significant place in Islamic wealth management, especially in the realm of investment and business practices. It serves as a fundamental pillar of Islamic finance, emphasizing social responsibility and fair distribution of wealth. In the context of investments, Zakat ensures that a portion of profits generated is allocated to those in need, fostering a culture of compassion and equity within the business landscape.

Moreover, Zakat plays a crucial role in shaping ethical business conduct and decision-making processes. By adhering to Islamic principles of wealth distribution, businesses can uphold integrity and justice in their operations. This not only promotes a sense of accountability but also builds trust among stakeholders, contributing to the overall sustainability and success of the business.

Integrating Islamic Principles in Financial Transactions

Islamic principles play a fundamental role in shaping financial transactions within the Muslim community. Upholding values such as justice, transparency, and ethical conduct is essential in ensuring that financial dealings adhere to the teachings of Islam. By integrating these principles into financial transactions, individuals and businesses can cultivate an environment of trust and accountability, fostering a sense of integrity and fairness in economic activities.

Furthermore, incorporating Islamic principles in financial transactions promotes the concept of mutual benefit and shared prosperity. In Islamic finance, transactions are structured to promote both individual success and community well-being, emphasizing the importance of equitable distribution of wealth. By adhering to these principles, financial transactions become a means not only to generate profits but also to contribute positively to the overall social and economic welfare of society.

Zakat's Role in Sustaining Community Development

Zakat plays a crucial role in sustaining community development within the Islamic framework. It serves as a mechanism for redistributing wealth to those in need, thereby fostering social equality and cohesion. By encouraging the affluent members of society to contribute a portion of their wealth to support the less fortunate, Zakat promotes a sense of solidarity among Muslims and strengthens the bonds of mutual support within the community. This practice not only alleviates the financial burdens of the disadvantaged but also creates a sense of shared responsibility and care that transcends individual wealth and status.

Moreover, Zakat serves as a tool for sustainable development by providing resources for education, healthcare, infrastructure, and other essential services for the community. By investing Zakat funds in projects that benefit the broader society, Islamic institutions can catalyze economic growth and improve the overall quality of life for all members of the community. Through effective Zakat management and allocation, communities can address pressing social issues, uplift marginalized groups, and create a more equitable and prosperous environment for everyone to thrive.

Fostering Solidarity and Mutual Support Among Muslims

Fostering solidarity and mutual support among Muslims is a fundamental aspect of the Islamic practice of Zakat. The obligation to give a portion of one's wealth to those in need helps to create a sense of unity and interconnectedness within the community. By fulfilling their Zakat duty, Muslims demonstrate their commitment to supporting one another, regardless of social or economic differences. This act of giving not only provides essential assistance to those less fortunate but also strengthens the bonds between individuals and helps to build a more cohesive society.

Furthermore, the practice of Zakat encourages a culture of generosity and compassion among Muslims, fostering a spirit of mutual care and empathy. When members of the community contribute towards Zakat, they actively participate in the collective well-being of their fellow believers. This collective responsibility promotes a sense of belonging and shared purpose, reinforcing the notion that the welfare of one individual is inherently linked to the welfare of the entire community. Through the continuous practice of giving Zakat, Muslims build a foundation of support and solidarity that transcends individual interests and contributes to the greater good of society.

Challenges and Opportunities in Zakat Management

Challenges in Zakat management arise due to issues such as lack of transparency in the collection and distribution processes, inefficient governance structures, and varying interpretations of Islamic jurisprudence. Ensuring that Zakat funds are utilized effectively and reach those in need can be hindered by bureaucratic hurdles and insufficient oversight mechanisms. Additionally, the emergence of modern financial instruments and global economic complexities pose challenges in aligning Zakat practices with contemporary wealth management frameworks.

On the other hand, opportunities in Zakat management include leveraging technology to streamline collection and distribution processes, enhancing financial literacy among Muslim communities to encourage voluntary contributions, and fostering partnerships with governmental and non-governmental organizations to scale up impact. By embracing innovative approaches and forming strategic collaborations, Zakat management can not only overcome existing challenges but also expand its role in promoting social welfare and sustainable community development.

Addressing Implementation Hurdles and Maximizing Impact

Addressing the challenges in the implementation of Zakat is crucial to ensure its maximum impact on society. One overarching issue is the lack of awareness and understanding among Muslims about the importance and proper calculation of Zakat. This hinders individuals from fulfilling their religious obligation effectively and contributes to the mismanagement of resources that could otherwise be used to uplift those in need.

Moreover, the absence of standardized processes and regulatory frameworks for Zakat collection and distribution poses a significant obstacle. Transparent and accountable mechanisms must be established to build trust among the Muslim community and encourage greater participation in Zakat initiatives. By streamlining procedures and promoting good governance practices, the efficiency and effectiveness of Zakat management can be enhanced, thereby amplifying its positive influence on community development.

FAQS

What is Zakat and why is it important in Islamic wealth management?

Zakat is a form of obligatory charity in Islam, where eligible Muslims donate a portion of their wealth to help those in need. It plays a crucial role in Islamic wealth management by promoting social justice and economic stability within the community.

How does Zakat contribute to community development?

Zakat plays a vital role in sustaining community development by providing financial assistance to the less fortunate members of society. It helps in alleviating poverty, promoting education, and supporting various social welfare programs.

Can Zakat be integrated into investment and business practices?

Yes, Zakat can be integrated into investment and business practices by ensuring that the wealth generated is halal (permissible) and that the required Zakat is paid on it. Islamic finance principles guide Muslims on how to invest and conduct business activities in accordance with Sharia laws.

What challenges and opportunities exist in Zakat management?

Challenges in Zakat management include issues related to transparency, accountability, and the effective distribution of funds. However, opportunities also exist to improve Zakat collection and distribution processes, enhance impact measurement, and leverage technology for efficient management.

How does Zakat promote solidarity and mutual support among Muslims?

Zakat fosters solidarity and mutual support among Muslims by encouraging the affluent members of the community to help the less fortunate. It creates a sense of social responsibility and unity, strengthening the bonds within the Muslim community.

Related Links

Family Office Services in Islamic FinanceSustainable Investing in Islamic Asset Management