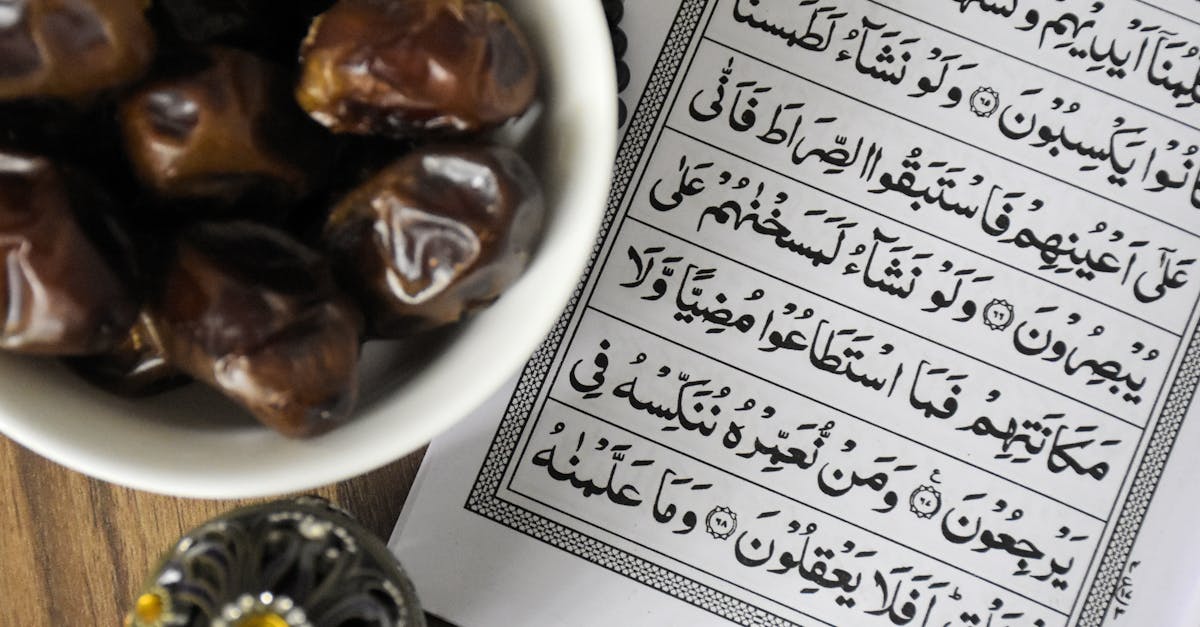

Islamic Money Market Funds

Table Of Contents

Regulatory Environment for Islamic Money Market Funds

The regulatory environment for Islamic money market funds plays a crucial role in ensuring compliance with Shariah principles. In Australia, the governance framework for these funds is overseen by relevant regulatory bodies to uphold ethical financial practices. It is essential for Islamic money market funds to adhere to strict guidelines and regulations set forth by these authorities to maintain transparency and trust among investors.

Regulatory authorities work closely with Shariah advisory boards to provide guidance on compliance issues and ensure that investments align with Islamic principles. The collaboration between regulatory bodies and Shariah advisors helps to uphold the integrity of Islamic money market funds and safeguard against any potential conflicts of interest. By fostering a robust regulatory environment, investors can have confidence in the ethical standards and financial stability of these investment vehicles.

Oversight by Shariah Advisory Boards

Shariah Advisory Boards play a crucial role in ensuring the compliance of Islamic money market funds with Shariah principles. These boards consist of Islamic scholars and financial experts who meticulously review the investment activities of the funds to certify that they adhere to Islamic laws. Through their oversight, Shariah Advisory Boards help investors maintain trust in the ethical integrity of their investments.

By providing guidance on permissible investment instruments and ensuring that prohibited activities such as gambling and investing in companies involved in alcohol or pork products are avoided, Shariah Advisory Boards contribute to the growth and sustainability of Islamic money market funds. Investors can have peace of mind knowing that their funds are managed in accordance with their religious beliefs and ethical values, fostering a sense of confidence and transparency in the financial system.

Global Growth of Islamic Money Market Funds

The global growth of Islamic money market funds has been steadily increasing in recent years. Investors are increasingly seeking ethical investment options that align with their Islamic principles, contributing to the rise in popularity of these funds. With a focus on avoiding interest-based investments and complying with Shariah principles, Islamic money market funds offer a unique proposition in the financial market landscape.

Moreover, the growing awareness and demand for socially responsible investments have also propelled the expansion of Islamic money market funds on a global scale. As more investors prioritise ethical considerations in their financial decisions, the appeal of these funds continues to grow. This trend showcases a shifting mindset towards sustainable and ethical investing practices, highlighting the significant potential for further development and expansion of Islamic money market funds in the future.

Increasing Demand for Ethical Investment Options

The increasing demand for ethical investment options has been a noticeable trend in the financial market in recent years. As more investors become conscious of the ethical implications of their financial decisions, there has been a shift towards seeking out investment opportunities that align with their values and principles. This demand has led to a rise in the popularity of Islamic money market funds, which are designed to comply with Islamic principles and ethical guidelines.

Investors are increasingly looking for ways to grow their wealth while also contributing to a more socially responsible and ethical financial system. Islamic money market funds, with their focus on ethical investing and adherence to Shariah principles, provide a viable option for investors seeking to align their financial goals with their ethical beliefs. As a result, the growth of Islamic money market funds is not only driven by the desire for financial returns but also by the increasing demand for investment vehicles that promote ethical and responsible investing practices.

Risks Associated with Islamic Money Market Funds

Similar to conventional money market funds, Islamic money market funds also come with certain risks that investors need to be aware of. One of the primary risks associated with Islamic money market funds is market volatility. Due to the fluctuations in asset values and market conditions, the net asset value of these funds can vary, affecting returns for investors.

Another risk to consider is liquidity issues. Islamic money market funds invest in short-term, low-risk assets, but in certain situations, these assets may become illiquid. This means that investors may face challenges in selling their shares or withdrawing funds quickly, especially during periods of market stress. It is important for investors to carefully assess their risk tolerance and investment objectives before committing funds to Islamic money market funds.

Market Volatility and Liquidity Issues

Islamic money market funds are not immune to market volatility and liquidity issues. These funds face similar challenges as conventional money market funds, including fluctuations in market conditions and potential liquidity constraints. Given the nature of their investments, Islamic money market funds may be susceptible to sudden changes in interest rates, credit spreads, and other financial variables that can impact their performance.

During periods of market volatility, Islamic money market funds may experience difficulty in maintaining a stable net asset value (NAV) due to fluctuations in the value of their underlying investments. Liquidity issues can arise when there is a mismatch between the fund's assets and liabilities, making it challenging to meet redemption requests from investors. To mitigate these risks, fund managers may adopt various strategies such as maintaining a diversified portfolio, monitoring market conditions closely, and adhering to Shariah principles in their investment decisions.

FAQS

What are Islamic Money Market Funds?

Islamic Money Market Funds are investment vehicles that comply with Islamic principles, such as the prohibition of interest (riba) and unethical investments. These funds invest in Shariah-compliant assets, such as Islamic bonds (sukuk) and trade in accordance with Islamic finance principles.

How are Islamic Money Market Funds regulated?

Islamic Money Market Funds are regulated by the relevant financial authorities in each country, ensuring compliance with Shariah principles and financial regulations. Oversight by Shariah Advisory Boards also plays a crucial role in ensuring the fund's investments are in line with Islamic ethics.

What is the global growth trend of Islamic Money Market Funds?

Islamic Money Market Funds have been experiencing significant growth globally, driven by the increasing demand for ethical investment options. Investors are seeking Shariah-compliant investment opportunities that align with their values, leading to the expansion of Islamic finance products.

What are the risks associated with investing in Islamic Money Market Funds?

Risks associated with Islamic Money Market Funds include market volatility and liquidity issues. While these funds aim to provide stable returns in compliance with Islamic principles, they are not immune to market fluctuations and liquidity constraints that may impact the fund's performance.

How can investors benefit from investing in Islamic Money Market Funds?

Investors can benefit from investing in Islamic Money Market Funds by diversifying their investment portfolio with Shariah-compliant assets. These funds offer a way to earn returns while adhering to Islamic principles, providing a socially responsible investment option for individuals and institutions.

Related Links

Islamic Hedge FundsIslamic Exchange-Traded Funds (ETFs)